Financial Freedom & The Cashflow Quadrant

Ever dreamed of no longer having to work for a living? Being able to leave the rat-race? No longer having to trade your time for money?

Let’s take a look at that.

Since we’re kind of on the subject of investing & getting through a few models, I thought I’d share another one with you that has been fairly life-changing for me, and also helps to answer the above questions (I’ll explain a little further too).

Covering investing, financial freedom and another useful model… what’s not to like?

The previous article about the Rule of 72 showed you a great short-cut or model to quickly calculate how long it takes to double your money at any given interest rate. That article also hopefully showed you the power of compound interest and if you took nothing else away from that I hope you took away the lesson that if you start saving or investing, then doing so as early as possible is the way to go.

Saving vs Investing

I nearly wrote an article today about saving vs investing because understanding the difference is quite important when it comes to money and a financial education.

Also my viewpoint on both differs from a lot of common advice out there (I know this because I just googled it).

Before I continue, a brief definition of both:

Saving is putting money aside in a safe place such as a savings account in a bank (ideally with a decent rate of return which may be achieved due to certain restrictions such as access to that money being quick but not necessarily instant).

Investing is trying to make your money work for you by committing it to some endeavour, project or bet in order to try and make a profit, in financial terms known as a return or return on investment (ROI). Investing may commonly be understood to be in financial market instruments such as stocks & shares, bonds etc but investment can literally be in anything at all that might give you that return so also includes property(real estate), buying assets that you can later sell at a higher price, businesses, trademarks, loans, copyrights, horses, watches, royalties, jewellery, contracts… anything in fact, the boundaries of what you can invest in are limited only by the imagination of those involved and the agreement (or ‘contract’, formal or otherwise) between the parties involved. Obviously the more obscure, creative or non-standard an investment is then the more careful you have to be (because it’s probably more risky and if it’s really obscure or promises too much in terms of great returns, it could well be a scam) and the more you need to do your due diligence.

There are plenty of articles out there that say something along the lines of ‘When should I save and when should I invest?’. Here in a nutshell is how my viewpoint differs slightly: I think you should be doing both.

It’s a bit outside of the scope of this article, but for now, my view (and you can disagree with it) is that whatever your circumstances and whatever your level of income, you should be saving and investing, from the first moment you can (i.e. as early as possible) and on a regular basis.

So I will write more on this later but this is already useful background for the model I am going to show you.

Life Changing Moments

You might be expecting me to tell you here that the Cashflow Model from Kiyosaki’s book changed my life. Not exactly (I’d already had that moment), but it helped.

The start for me was way before I discovered the Cashflow Model and had already decided to take my own, different approach to pursuing wealth. So as I said earlier, the model was fairly life-changing because it gave me more focus and confirmed a path I was already on.

The life changing moment for me was a kind of light-bulb moment when a colleague (by the name of Johann Wipplinger) of mine simply said to me:

‘You will never make your money just working your job’

Johann, if you’re out there, thanks for this, I didn’t know it at the time but this comment was the start of a new path for me and has therefore changed my life (I’d be amazed if Johann ever reads this by the way, but you never know. In case this miracle does happen, Johann, please leave a brief comment below or find me somehow (not difficult, subscribe to mailing list & reply to the welcome mail if nothing else), it would be great to get back in touch after all these years).

What I understood from Johann’s comment and the way it was said is that however successful we become in our careers (and we already had pretty good jobs with a good employer), you will never make your true potential working for somebody else.

This also happens to be the lesson of Kiyosaki’s Cashflow Quadrant.

From the day Johann made that comment to me, I set myself the goal of having 10 income streams. My job was just one of these, I needed 9 other ways to make money. That idea has informed many projects and money making ventures since (since being in the last 25 or so years). An obvious inherent goal in my 10 income stream idea (because it’s very difficult to do 10 different money-making things at once) was to make as many of these income streams as passive as possible – ultimately all of them.

There did become a day (which was at or very close to financial freedom for me) back in 2010 when I removed my job from that list.

Note: my personal interpretation of financial freedom is not the same as being ‘rich’ – it is simply that you don’t have to depend upon employment in order to finance the life you want to live.

Now let’s take a look at the Kiyosaki model…

Kiyosaki’s Cashflow Quadrant

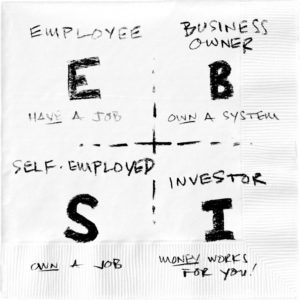

Here it is (with some annotations added):

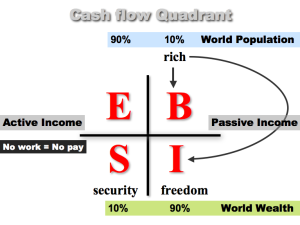

Once you’ve understood how the model works, consider in this annotated version the World Population vs World Wealth comparison and that probably tells you all you need to know – specifically why it’s a good idea to get your a$$ over to the right.

Cashflow Quadrants

The model comes from Robert Kiyosaki’s book ‘Rich Dad, Poor Dad‘. I’m not going to comment too much on the book aside to say it’s an interesting read, and worth it if for nothing else, for this model which is one of the best parts of it.

The model has four sections (quadrants) depicting different types of people in terms of how they make their money. You can be in multiple quadrants though most people will be mostly in one (most people are in the top left quadrant and most of those will also stay there).

The left 2 quadrants (E and S) are active income, meaning you have to be there and active to make the money or as Kiyosaki puts it, trade your time for money. The right 2 quadrants are hands-off, you don’t have to be there and therefore these quadrants (B and I) relate to passive income.

E – Employee

In this quadrant you have a job. J.O.B. (=’Just Over Broke’ to the financial guru’s selling their financial education training courses and over-priced seminars). As I said already, this covers most people. Some are perfectly happy just sitting here because some people have great jobs. In Kiyosaki’s book he wants you to get out of this quadrant because the only way to make money in this area is by trading your time for money. It is the quadrant in which you have the least control (you have to show up for work otherwise you may be fired leading to stress and a lack of security if this is your only income). If you want to earn more money, you must work more hours. With this position in the quadrant there is no passive income. If you don’t work, you don’t make any money.

S – Self Employed

You have a little more control here because you are your own boss. This quadrant covers contractors (sole-traders), freelancers, gig-economy workers and small businesses where the owner of that small business still needs to be actively working for the business to work – i.e. still trading time for money. You have a little more personal and financial freedom because you own the business, you choose when to take holidays (though most contractors I know are more conscious of losing money as it is then unpaid leave and they are very conscious of the money they *could* be making instead of taking a holiday – even though they earn more than employees, the time for money relationship is even more apparent so they take less time off generally not more (despite making more money). Long story short – you own your own business, but in reality the business owns you.

B – Business Owner

In Kyosaki’s model the B represents Business Owners who have managed to extract themselves from having to actually work in the business. Business owners in this quadrant are likely to be larger businesses with a reasonable number of employees (but not necessarily the case) – the key is that the business owner is hands-off he or she leaves the day to day running of the business to his/her employees and benefits from a passive income from the business (or businesses).

I – Investor

As I described earlier, investing is actually using your money to generate more money. You are investing your money into something to make a return. This activity is speculative in nature and will carry an element of risk. The key to good investment is managing that risk in order to realise the best returns possible. Sound investments can allow you to retire. These investments are things that you build once and have a long timespan in payouts. They are also the most passive of passive incomes.

Final Thought

So to answer the initial question, ‘What does it take to achieve Financial Freedom?’, if you get to a situation where you are on the right hand side of the quadrant so that you no longer have to trade your time for money and therefore can literally do what you want with (every minute of) your own time, then I’d say you have achieved financial freedom.

How do you get there?

Well, obviously this varies due to circumstance, environment and opportunities you are presented with, but it starts with understanding and a financial education (which hopefully this article and others including the previous one form part of), then with actually doing something about it – i.e. start investing.

These days it is more possible than ever to make small investments and take baby steps toward being an investor.

This is hugely important and hugely useful because it means you can learn a lot – particularly because you are still dealing with real money – without risking large sums. The best way to learn is by doing and as investment is scalable (£100 at a 10%p.a. ROI is exactly the same as 100 x £1 at a 10%p.a. ROI) and compound interest is powerful as we saw in the previous article you get the experience for real and the power of ‘if I can make $1, I can make $100‘ along with being amazed at how quickly you can actually start making money.

P.S.: the other good news is that in writing this I am slowly getting through my list of 100 Management Models and When To Use Them (very slowly, I wrote that article 7 years ago lol) so if you want to see more really useful models on our core topics of business success, lifestyle design and financial freedom, do check out that list. I personally think it will be really cool and an amazingly useful resource when I’ve eventually written about all of them. I’ll probably be 90 years old by the time I do, but it’s gonna be awesome…

So many authors talk about FF and early retirement, but don’t talk about cash flow. The cashflow quadrant works so well as part of the FF strategy. Thanks for pointing this out.